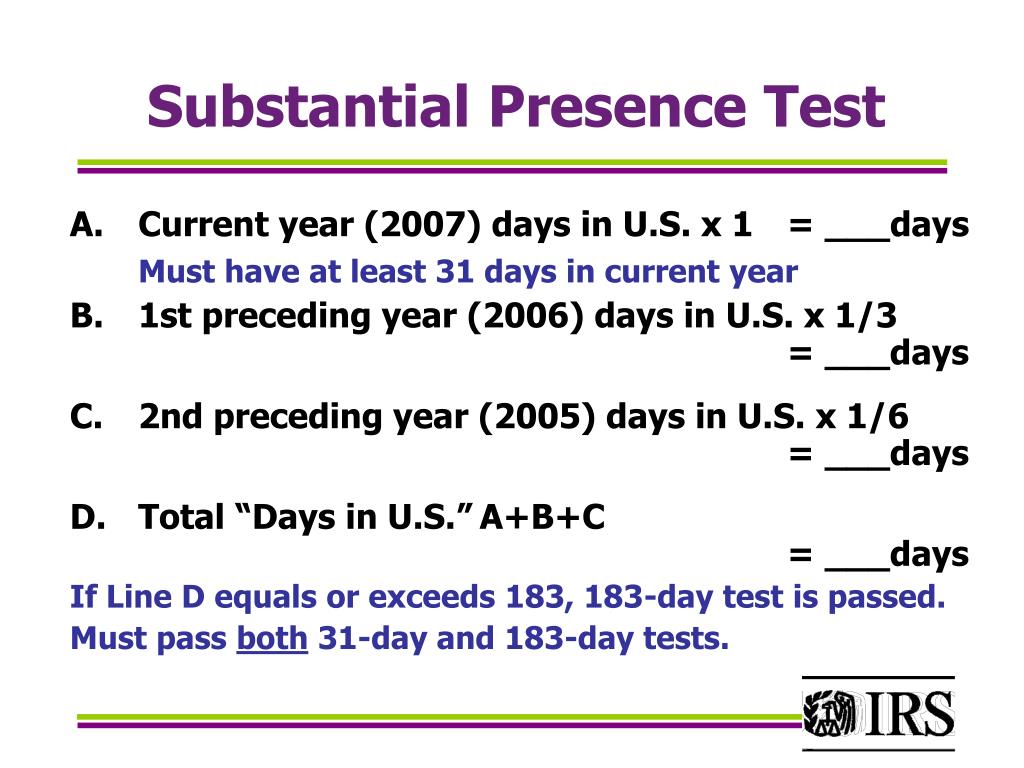

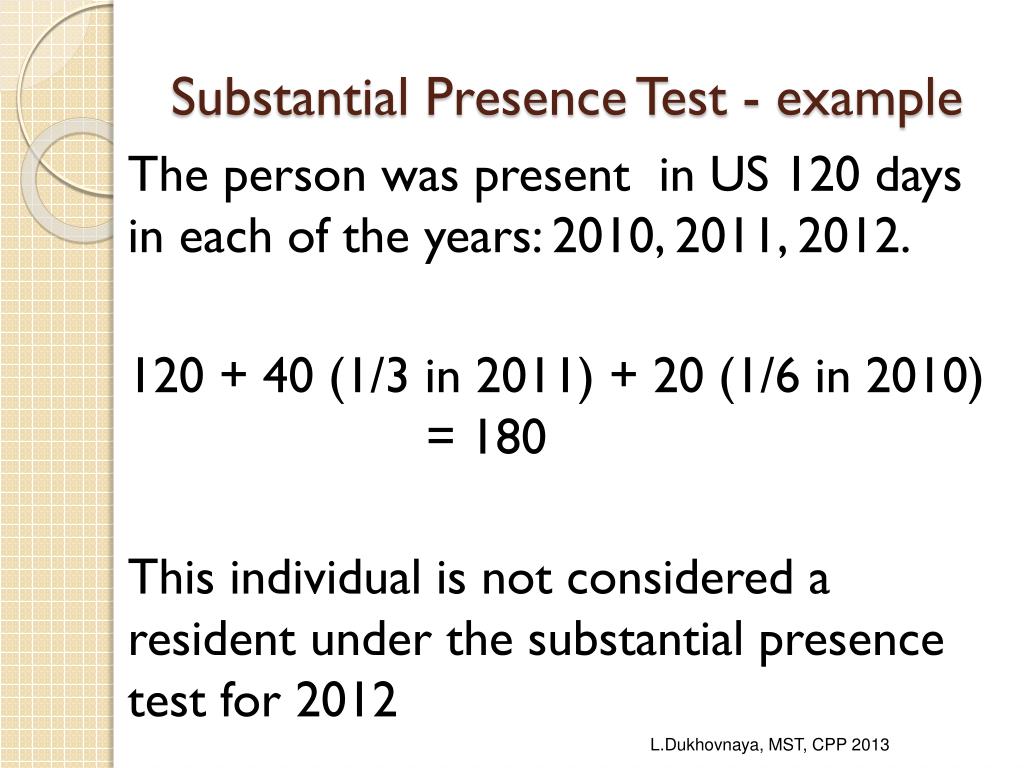

If total equals 182 days or less = Nonresident for Tax If total equals 183 days or more = Resident for Tax (*note exception below) To meet this test, you must be physically present in the United States for at least:ģ1 days during the current year, and 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:Īll the days you were present in the current year, andġ/3 of the days you were present in the first year before the current year, andġ/6 of the days you were present in the second year before the current year. You will be considered a 'resident for tax purposes' if you meet the Substantial Presence Test for the previous calendar year. You are a 'resident for tax purposes' if you were a legal permanent resident of the United States any time during the past calendar year.

citizen, you are considered a ' non-resident for tax purposes' unless you meet the criteria for one of the following tests: 1: The “Green Card” Test See below to determine whether or not you are considered a 'resident for tax purposes'. Your tax residency status depends on your current immigration status and/or how long you've been in the U.S. tax system, foreign nationals are considered either ' non-residents for tax purposes' or ' residents for tax purposes'.

#SUBSTANTIAL PRESENCE TEST CALCULATOR HOW TO#

0 kommentar(er)

0 kommentar(er)